How to Recover my bad debt? Muds Management

11 Tháng Chín, 2020

Contents:

You just lend a few hundred to your friend, its amounts to debt. In business, it arises more often when goods or services are supplied in credit terms. Customers commonly take a car loan when purchasing vehicles. They can pay back an amount as a downpayment to reduce the interest rates they owe on the car. When a car loan lender considers an amount as bad debt, the lender moves the debt from the asset to the liability column. Thereby, the loan amount is deemed non-recoverable to the lender.

Bad Debt Recovery: Definition and Tax Treatment – Investopedia

Bad Debt Recovery: Definition and Tax Treatment.

Posted: Sun, 26 Mar 2017 05:38:43 GMT [source]

– A business entity that sells and purchases the goods on credit, might incur Bad Debts in case his or her customer didn’t oblige to the predefined sets of terms and conditions of the payment for the purchase of these goods. The Allowance for doubtful accounts is recorded in the annual financial statements as an Allowance for doubtful accounts. In the undergoing paras, I have tried to explain in a nutshell the legal provisions of Bad Debts write off for the normal businesses and Banking Sectors under Income Tax Act 1961 and Goods and Services Tax Act 2017.

FAQs on bad debt journal entry

To record this receipt, cash account will be debited and _________ account will be credited. We know that bad debt is a loss and is adjusted with the current year’s Profit & Loss A/c. Now, if the amount of bad debt is received in any succeeding year, the same will be credited to Profit and Loss of that year as an income.

Later if the amount is settled, he must deduct the amount from the provisions account. If the creditor doesn’t receive the amount he must consider it as bad debt and must write off the same. These records give an accurate estimate of the receivables. Thus the creditor can avoid current assets from being overstated.

The reason for nonpayment by the debtors is that either they go bankrupt, have financial problems or collection by the creditors due to various reasons is not possible. For example – X Limited sells goods on retail to a retailer at 60 days credit. The bad debts or a provision for bad debt is reduced from debtors and the net figure is shown in thebalance sheet. A Bad Debt expense is recognized, at the time when a receivable is no longer collected as the customer is not able to fulfil their obligation to pay the outstanding Debt for the bankruptcy or other financial problems.

Bad Debts of Discontinued Business

They record the uncollectible money as expenditure on company financial records whenever this occurs. There are numerous reasons why a business cannot fully recover a debt, including claims and disputes, insolvency, and clients who simply refuse to pay. It means that the assessment made for these years shall be re-opened and total income shall be recomputed after allowing the claim for bad debts. No deduction in respect of bad debt is allowable under section 36 unless it is written off as irrecoverable in the books of the assessee in the previous year in which claim for deduction is made††.

You must write off debts using this method when it becomes difficult or impossible for you to recover the debt. This is normally done by creating a reserve for discount on creditors and then transferring the discount received to such reserve. Rs. 1,500 received from Ram which were written off as bad-debts earlie…

D – Received Commission – 12,000

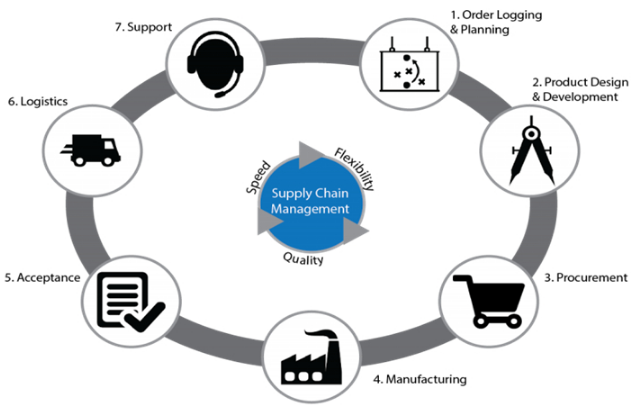

In such cases, as a business, you may seek help from third-party collector services or agencies to reach out to the customer for payment retrieval. With this, businesses can take advantage of removing bad debt from their financial records as it shows a history of timely payment recovery. Non-payment of goods or services can also be protected by using trade credit insurance. This insurance protects the company from non-payment of invoices and bad debts.

Clear can also help you in getting your business registered for Goods & Services Tax Law. An entity that buys and sells goods with credit allows customers to accept predefined payment terms for purchasing goods. – For a person who is engaged in providing the loans, if a receiver does not repay his or her dues, then this will also amount to Bad Debts. – Similarly for a trader, a service provider may also incur Bad Debt loss in case his or her client does not repay the fees after utilizing the services provided by the service providers.

- Machinery (Book value ₹ 6,00,000) was handed over to a creditor at a discount of 10%.

- Thus, this is a final warning to the debtor to avoid any legal proceedings.

- To write off bad debt, you need to remove it from the amount in your accounts book.

- After successful completion of my 8 years service, I have decided to move Pune.

You must remember to settle this bad debt quickly as you have the cash since the debt’s borrowing costs add up quickly. So when considering this bad debt, you have to move the debt from the asset to the liability column to make the loan amount non-recoverable. The business records this uncollectible money as an expenditure on the company’s financial records whenever this occurs.

Loss AccOun

bad debts recovered entry is a situation when an individual or an organization is unable to meet its financial obligations with its lenders. In legal terms, it is a situation when a firm’s or person’s liabilities exceed their assets and they fail to pay their debt on the due date. The SEBI circular mandates that, as of April 1st 2023, physical shareholder folios that are missing any of the data—such as a PAN, email address, mobile number, bank account details, or nomination—must be frozen. But when the situation of your customers gets worse or your belief that he will pay you is in doubt, is when you got to deal with the debts differently.

Why Do Banks Write Off Bad Debt? – Investopedia

Why Do Banks Write Off Bad Debt?.

Posted: Wed, 30 Jun 2021 07:00:00 GMT [source]

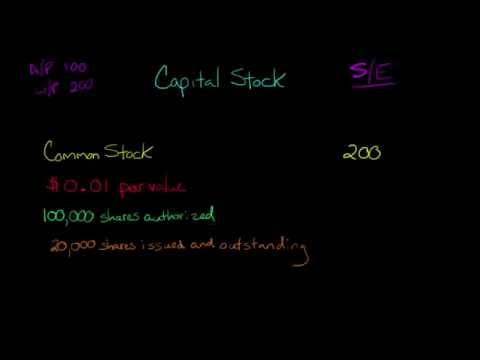

Under the provision or allowance method of accounting, businesses credit the “Accounts Receivable” category on the balance sheet as per the amount of the uncollected debt. To balance the balance sheet, a debit entry for the same amount is entered into the “Allowance for Doubtful Accounts” column. Therefore, to show the approximately true value of the sundry debtors in the balance sheet a provision or reserve is created for possible bad debts. Such an adjustment entry is recorded at the end of accounting year.

One of the most convenient method of recovery of bad debt is mediation. Mediators are trained professionals appointed to settle the matter between the creditors and the debtors. The mediator is completely neutral and tries to understand each party’s position. He focuses on the issue and then tries to find a solution that suits both the parties. This is a faster process as compared to courtroom litigation and a mediator can be arranged within a day if both the parties agree to resolve their issues through mediation. After 60 days, the company realizes that the debtors have gone bankrupt and now recovery of money is not possible.

The order of discharge by the court releases the insolvent from all current and provable debts. Once the person is declared an insolvent, the court appoints an official administrator to oversee the liquidation, take charge on the property of the insolvent and then divide them among the creditors to pay back their debts. If debtors fail to pay their debts, an insolvency petition can be presented before the court by the debtor or creditor. An insolvency petition can be preferred only when the debt amount exceeds five hundred rupees. When an insolvency petition is presented by the debtor, it is considered as an act of insolvency and court may make an order of adjudication where his property may be attached and used to fulfill the debts which are due by him. Bad debt recovered is credited to provision for bad and doubtful debts.

When the loan is written-off, the bank frees Rs.10,000 which was initially set aside for provisioning. This freed up money can be used for other business purposes by the bank. Much patience in understanding the customers/students requirement and also understand the levels of skills and build the career for effective use of Tally.ERP 9.

Continue reading to undehttps://1investing.in/tand what is a write off and why banks do it. Balance sheet, you have a provision to reduce bad debt from debtors, and then you can view the net figure in the balance sheet. Your business can seek help from third-party collector services or agencies to reach out to your customers for payment retrieval. You can do this when your customer refuses to pay after purchasing goods or services. A personal loan is the sum of cash you borrow from a creditor to fund a personal project.

Based on the analysis, we help you discover loans and credit cards best suited for your credit profile. We help you understand your Credit Profile, Credit Information Report and know where you stand. We ensure that you have a better shot at getting an approval for a loan or credit card you apply since we match the lender’s criteria to your credit profile. We help you avoid loan rejection by carefully determining your eligibility and matching you with the right lender/product.

Forex Trading Terminology Basic Forex Terminology

29 Tháng Chín, 2021

The Biggest Winners & Losers of the U S Stock Market in 2019

08 Tháng Sáu, 2021

Economic News: Q4 Investment Outlook

23 Tháng Chín, 2022

Kalendarz ekonomiczny Forex Analizy, Komentarze Giełdowe, Aktualne Kursy

04 Tháng Tám, 2022

5 Factors to consider when choosing a Forex Broker in 2020

20 Tháng Bảy, 2022

Buy Sell Bitcoin, Ether and Altcoins Cryptocurrency Exchange

27 Tháng Tư, 2022

Avadhut Sathe Trading Academy YouTube Stats: Subscriber Count, Views & Upload Schedule

09 Tháng Mười Hai, 2021

Russia Partially Lifts Ban On Forex Trading By Western Banks

04 Tháng Mười, 2021

Forex Trading Terminology Basic Forex Terminology

29 Tháng Chín, 2021

The Biggest Winners & Losers of the U S Stock Market in 2019

08 Tháng Sáu, 2021

Economic News: Q4 Investment Outlook

23 Tháng Chín, 2022

Kalendarz ekonomiczny Forex Analizy, Komentarze Giełdowe, Aktualne Kursy

04 Tháng Tám, 2022